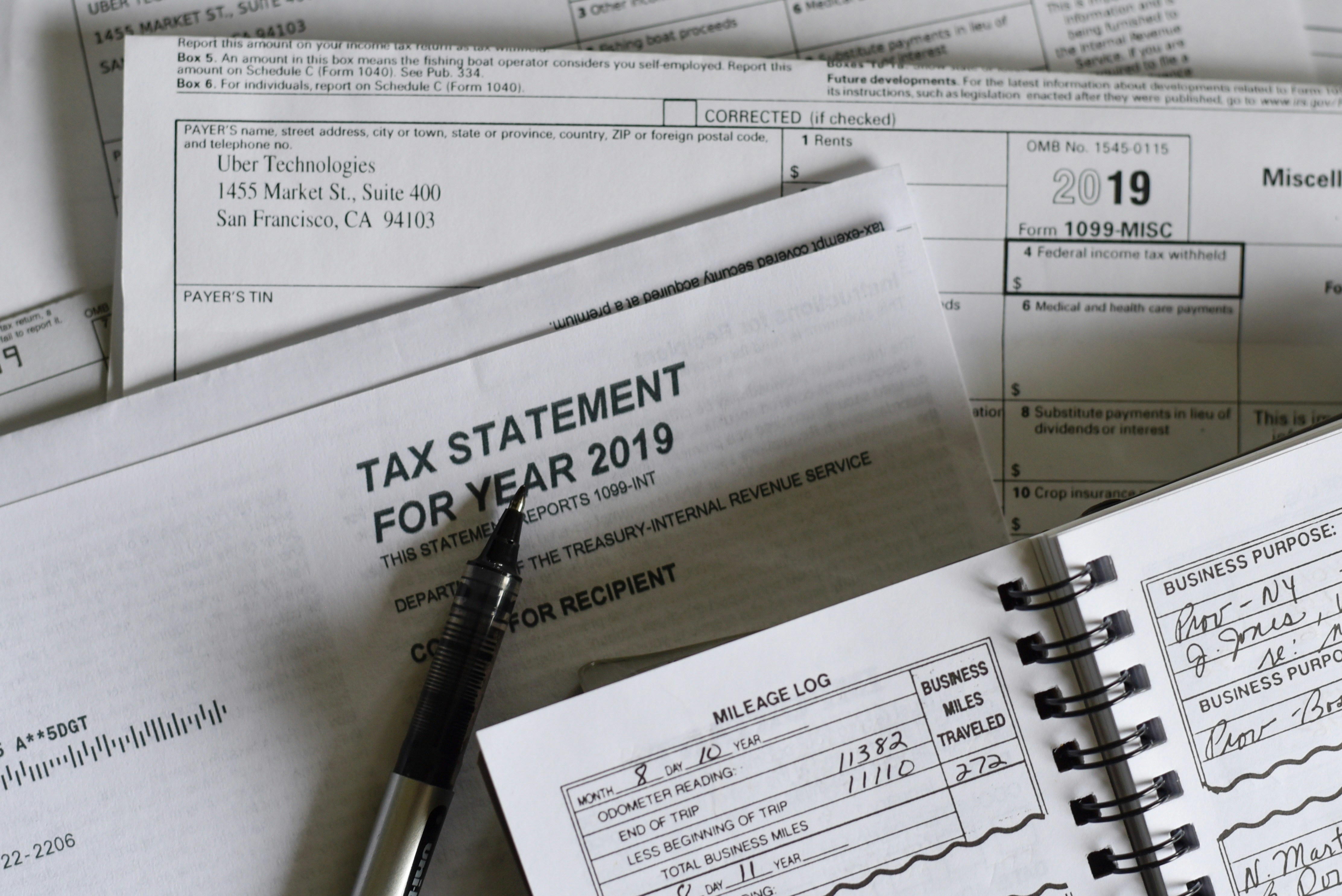

Tax Services

At Ortrando, Porcaro & Associates, LTD, we specialize in delivering comprehensive tax solutions tailored to meet your individual and business needs. From ensuring compliance with ever-changing tax regulations to providing expert guidance on tax planning and estate strategies, our team is dedicated to helping you optimize your financial outcomes. Whether it’s preparing a simple individual tax return or navigating the complexities of corporate and nonprofit filings, we are committed to offering personalized, detail-oriented service that ensures peace of mind and long-term success.

Tax Compliance

At Otrando Porcaro and Associates, LTD, we ensure your business meets all tax obligations with our comprehensive tax compliance services. We help you navigate the complexities of tax laws and regulations to avoid penalties and optimize your tax position. Our services include preparation and filing of various tax forms, such as:

- Individual Tax Returns (Form 1040)

- Corporate Tax Returns (Form 1120)

- S Corporation Tax Returns (Form 1120-S)

- Partnership Tax Returns (Form 1065)

- Estate and Trust Tax Returns (Form 1041)

- Non-Profit Organization Tax Returns (Form 990)

- State and Local Tax Returns

Tax Planning

Effective tax planning involves strategic timing of income, purchases, and expenditures, selecting the right investments and retirement plans, and optimizing filing status and deductions. OPA helps minimize your tax liability through careful planning and expert advice.

Estate Planning

Estate planning isn’t just for the wealthy. It can be as straightforward as having a will and naming beneficiaries for your 401(k), or as complex as establishing multiple trusts. We help you create an estate plan that ensures your wishes are honored.